Covid-19: Issues for Non-life Firms to Consider

by Alex Marcuson

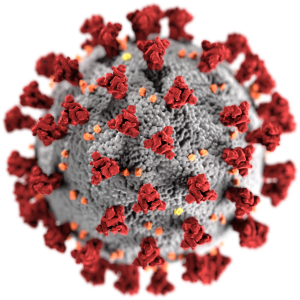

I have been thinking about how Covid-19 may affect the non-life insurance and reinsurance industry over the last week and thought I would share some observations. While there remains some uncertainty in both the short and long-term, emerging sickness and mortality rates suggest that this will be a disruptive rather than calamitous event for firms. However, the military adage of hope for the best but prepare for the worst appears appropriate.

1. Operational Risk Issues

An ability for staff to work remotely will be key. While individual plans and testing may not present issues, we do not yet know whether domestic internet infrastructure will be able to deliver the bandwidth needed in the peak scenarios that are forecast. This will be particularly acute if high proportions of the workforce choose to stay at home to minimise their risk of exposure to others.

We also do not know how workforces will cope with widespread school closures. Homeworking is all well and good when the kids are not around, but if they need supervision or are being entertained by using up internet bandwidth (possibly by remote schooling), the harmonious image of the remote-working employee may be shattered.

With employees adapting to different working processes and environments, firms need to be on their guard against the increased risk of opportunistic fraudulent activity by actors looking to take advantage of mistakes.

2. Impact on Claims

My current impression is that direct loss impacts will not be severe for most underwriters, however we should expect some surprises. While it is the norm for communicable diseases to be a standard exclusion for contingency policies, sometimes these are bought back. If these have been given away cheaply in the recent soft market, things could look uncomfortable. Similarly, underwriting pain will arise if many more major sporting and cultural events get cancelled, most notably the Olympic and Paralympic Games.

The wider underwriting picture remains unclear. Increased losses in PA and travel books look highly likely, but many other classes could be at risk, examples being:

- Economic stresses causing rioting or seizure claims.

- Project delays and cancellations.

- Asset seizure and quarantining.

- Surety and other financial guarantees where contract performance or a firm fails.

- Increased incidence of E&O, where a key team member is unable to perform their role, or D&O, where a firm fails to have adequate contingency plans in place.

Policy wordings will be particularly important here; for example, will policies respond if there is no event formally declared that will act as a trigger? And how far can losses be blamed on this disease when many other economic factors may be to blame?

3. Reserving Implications

A serious workplace disruption will affect the claims data used by actuaries, both immediately and in future. Delays in claims notification or a slow-down in claim settlement will need detecting and quantifying. Actuaries will need to be on their guard for such distortions as it will not always be clear how to address them.

4. Impact on capital

Thankfully, current indications are that Covid-19 will prove to be highly disruptive for a short period, but not something that should imperil soundly managed and capitalised insurance firms. Nevertheless, it does highlight the shape of severe pandemic scenarios and provide a recent data point for risk modellers to consider, particularly when assessing whether dependency assumptions remain appropriate. Firms will need to consider how underwriting losses correlate with severe equity market falls, the collapse in oil prices, company failures, operational risk losses and reduced premium activity.

5. Slowdown effects

Possibly more significant will be the loss of premium income arising from any economic slowdown. The interconnected world, with supply chains rooted in China may take some time to get back to normal. The NASA charts showing how nitrogen dioxide emissions have fallen over China indicates how stark the drop has been there. This will take time to work through the global economy. While service-focussed economies with strong central banks and extensive private and public IT infrastructure in place may have a greater level of robustness, the ultimate test of economic resilience may come from the ability of each country’s internet backbone to support the substantially increased projected levels of homeworking required.

6. Looking further ahead…

Two final thoughts to keep at the back of your mind for later this year and early-next:

- What interim staff will be needed to clear backlogs, especially the extensive regulatory and other reporting requirements on insurance firms?

- Will we get a spike in requests for parental leave where the workforce has endured extended periods of enforced time at home?

Time will tell.